EdisonTV

Endeavour Mining

EdisonTV | Mining | 29/10/2018

Bitesize briefing - Endeavour Mining

In this video, Edison’s Charlie Gibson talks about his initiation note on Endeavour Mining, including its valuation and what will drive the share price over the course of the next four years. Read the full report

Gold – Five things investors need to know

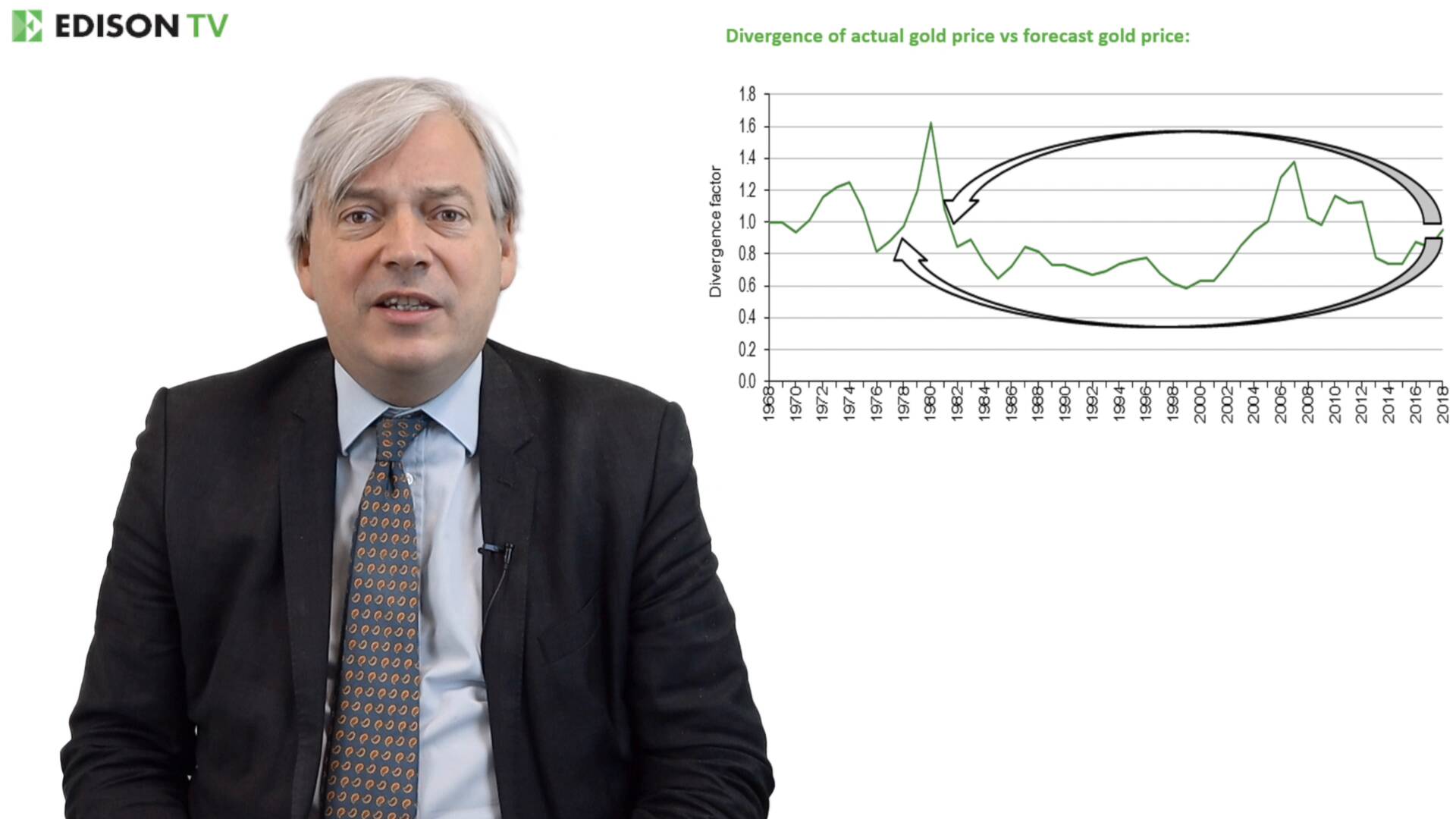

Edison’s Shades of the 1970s report is the latest in our series of reports on gold. It provides an in-depth analysis of gold price trends and forecasts. Here are five key takeaways from the report:

Rising interest rates have set the stage for another 1970s-style gold bull run. Just like back in 1979, real rates turning decisively positive in May 2023 indicates significant volatility ahead.

Historical data show gold prices rebased much higher after real rates went from negative to positive in the Seventies. On past precedent, we could see prices realistically over $3,000/oz and, potentially, as high as $4,500/oz.

The extended 2004–23 crisis has uncanny similarities with 1971–81. This suggests substantial latent inflation in the US economy that could further boost gold.

While expensive relative to CPI, gold is actually correctly priced based on the total US monetary base. This points to future dollar devaluation and inflation pick-up.

Multiple statistical analyses predict a new gold price range of $1,900–$2,900/oz this decade, which is 15–50% above prior forecasts.

In summary, political and economic parallels with the tempestuous 1970s foreshadow another dynamic gold bull run, with prices likely rebasing even higher amid latent inflation and significant currency devaluation.

To read the full report click here.

Watch »

22/11/2023 |

The Metals Company - executive interview

In this interview we talk to Gerard Barron, executive chairman and CEO of The Metals Company, which is looking to retrieve polymetallic nodules rich in nickel, cobalt, copper and manganese from the deep seabed in the Pacific Ocean. He talks about the company’s potential as a supplier of battery metals for the automotive sector as it looks to decarbonise against current solutions. He reports on the operational results of recent in-situ sea trials and expectations from the environmental studies which also took place. He discusses the licensing regulation and process which is due for approval in 2023 and provides insight into the likely timeframe for the first vehicle to be powered by a battery using metals supplied by The Metals Company

Watch »

17/01/2023 | The Metals Company

Sylvania Platinum - executive interview

In this video, Jaco Prinsloo, Sylvania Platinum’s CEO, gives an update on the company’s exploration assets following the release of an updated mineral resource estimate and a scoping study on its flagship Volspruit exploration project. Sylvania generates its revenue by extracting platinum group metals (PGMs) from six chrome tailings and other mine dumps and has no underground mine exposure. In addition to its mine dump operations, the company has a number of exploration assets in the northern limb of the Bushveld Complex in South Africa. Sylvania has exceptional cash-generating capacity given the high prices of PGMs, especially rhodium, and the low-cost nature of a surface dump retreatment operation, paying high ordinary dividends as well as windfall dividends. The announcement of the exploration project results includes an NPV of $27.3m for part of the Volspruit project excluding the 5-6% revenue contribution from rhodium as this is not yet JORC (a generally accepted mineral resources code) compliant, but will add orders of magnitude of value to the project. Also, exploration drilling on its Far Northern Limb (FNL) project has unexpectedly intersected the T-Zone, a reef which also occurs on the neighbouring PGM project near the FNL, also a significantly value-enhancing discovery which outcrops on surface in the FNL. With further drilling, the value of both these areas is likely to add huge value. Whether Sylvania proceeds with these projects on its own or enters into a JV with partners are options not yet decided. Jaco also briefly talks about the Q123 results, which were the fourth best in the company’s history.

Watch »

04/11/2022 | Sylvania Platinum

KEFI – executive interview

In its recent third quarter operational update, KEFI Gold and Copper (LN.KEFI) announced that it was aiming for full Tulu Kapi project launch by the end of the 2022 calendar year. In this interview, Edison’s head of mining research, Lord Ashbourne, talks to KEFI’s founder and executive chairman, Harry Anagnostaras-Adams to find out what this will mean for the company.

Watch »

01/11/2022 | KEFI Gold and Copper

Introduction to Sylvania Platinum, a unique and differentiated PGM producer

In this video, Jaco Prinsloo, Sylvania’s managing director, introduces this unique junior PGM producer, which generates its revenue in large part by extracting platinum group metals (PGMs) from its six chrome tailings and other mine dumps. In addition to its mine dump operations, the company has a number of exploration assets in the northern limb of the Bushveld Complex in South Africa. Jaco highlights that Sylvania has no underground mine exposure and has grown its production capacity to 70,000–75,000oz per year. The company takes pride in its operational standards, active shareholder interaction and in returning value to shareholders. He discusses some production issues experienced in H122 (Sylvania has a June year-end) and how they are successfully being negotiated. He delves into the unique metal mix produced by the company, with higher-than-normal exposure to rhodium, iridium, ruthenium and nickel, all of which are benefiting from increased demand and higher prices. He also highlights that Sylvania is one of only two South African PGM producers that have taken the active step of declaring windfall dividends to share their successes in generating profits and cash with investors and he details Sylvania’s dividend policy going forward. Sylvania has its operations in South Africa but is listed on AIM with a market capitalisation of £284m.

Watch »

03/03/2022 | Sylvania Platinum

Watch Lepidico ETV: The alternative to a complex portfolio

The lithium cycle has turned. Prices have taken off during 2021 and, as the impact of cleantech’s exponential growth becomes clearer, demand estimates continue to be upgraded, suggesting lithium prices have yet to peak.

Yet getting exposure to this expected price uplift via equities is not simple. The smart money is in studying each lithium company in detail – navigating a multidimensional minefield of rapidly evolving battery tech, greenhouse emissions, waste management, questionable impacts of water extraction and the integration of the up- and downstream, as well as security of supply and startups that make big claims about the future, but have uncertain horizons with early-stage technologies.

Lepidico exists largely outside this complex landscape. In this short interview CEO Joe Walsh explains why.

Watch »

08/09/2021 | Lepidico

Webinar: Pan African Resources

Pan African Resources is a mid-tier, Africa-focused gold producer, dual-listed on the AIM segment of the LSE and the Johannesburg Stock Exchange, as well as a sponsored Level 1 ADR programme in the US. The company has three major producing assets in South Africa, with total production capacity of 200,000oz of gold pa. These include its flagship Barberton Mines complex, the Barberton Tailings Retreatment Project (or BTRP) and Elikhulu, which now incorporates the Evander Tailings Retreatment Project (or ETRP). With a strong focus on safety and environmental, social and corporate governance (ESG), Pan African’s strategy is to deliver value-accretive projects with low-cost production and manageable execution risk.

In this webinar, Cobus Loots, Pan African Resources' CEO, presents an overview of the company’s recent operating and financial activities. A brief Q&A session will follow the presentation.

Watch »

03/12/2020 | Pan African Resources

Pan African Resources - executive interview

Pan African Resources is a mid-tier, Africa-focused gold producer, dual-listed on the London AIM Market and the Johannesburg Stock Exchange, as well as a sponsored Level-1 ADR programme in the US. The company has three major producing assets in South Africa, with total production capacity of 200,000oz of gold pa. These include its flagship Barberton Mines complex, the Barberton Tailings Retreatment Project (or BTRP) and Elikhulu, which now incorporates the Evander Tailings Retreatment Project (or ETRP). With a strong focus on both safety and ESG, Pan African's strategy is to deliver value-accretive projects with low-cost production and manageable execution risk.

Watch »

17/09/2020 | Pan African Resources

Lepidico - executive interview

Lepidico recently released the results of its definitive feasibility study (DFS) for its Phase 1 lithium project in Namibia and Abu Dhabi. The project has several points of differentiation and in this video Lepidico's managing director, Joe Walsh, explains what these are and why he is confident the DFS provides the platform for Lepidico to reach final investment decision for the project in H121.

Lepidico provides exposure to lithium, caesium and rubidium assets in Namibia along with its proprietary IP. It is well advanced in transitioning to development and into operation following successful completion of the Phase 1 project DFS.

Watch »

04/06/2020 | Lepidico

Executive interview - Wheaton Precious Metals

Wheaton Precious Metals was founded in 2004. The company's vision is to be the world’s premier precious metals investment vehicle. The streaming model Wheaton employs offers shareholders many advantages relative to both mining companies and direct investment in bullion or gold ETFs. The company provides commodity price leverage, exploration upside and an attractive valuation, while having predictable capital and operating costs, a high quality asset base and a sustainable dividend policy. The portfolio contains a diverse list of high quality, low cost, long life assets. The balance sheet is strong and there is ample opportunity to reinvest in new projects, pay down debt and boost returns to shareholders.

In this interview, Randy Smallwood, president and CEO of Wheaton Precious Metals, discusses the concept of streaming, what differentiates Wheaton's strategy from its peers, and the focus on ESG and sustainability. This is followed by an explanation of how a new stream is acquired, the priorities for uses of cash, where new growth is likely to come from and why he believes investors should invest in a streaming business.

Watch »

29/11/2019 | Wheaton Precious Metals

Bitesize briefing - Global lithium resources by country

In this week’s video we examine the global lithium resource base by country.

Watch »

30/09/2019 |

Bitesize briefing - Margins of Australian spodumene concentrate producers

In this video, we look at the margins of listed Australian spodumene concentrate producers during the quarter ending 30 June.

Watch »

23/09/2019 |

Bitesize briefing - Australian spodumene concentrate production, what went wrong?

In this video we look at production levels, sales and the build up of unsold product from the listed Australian spodumene concentrate producing mines.

Watch »

16/09/2019 |

Bitesize briefing - Gold: Doves in the ascendant

In this video, Edison’s mining head of research, Charlie Gibson, outlines the changes to his gold price forecasts for the next decade and beyond in the light of new evidence.

Watch »

19/08/2019 |

Bitesize briefing: Changes to the Australian spodumene concentrate production landscape

In this video we look at Australian-listed companies to see how production levels for spodumene concentrate have changed over the past 12 months.

Watch »

12/08/2019 |

Executive interview - Snow Lake Resources

Snow Lake Resources is a private lithium development company that is seeking to move its Thompson Bothers spodumene project into near-term and low-capex production. The Thompson Brothers deposit is located in Snow Lake in Manitoba, Canada. The project has a Historic JORC compliant mineral resource estimate of 6.3mt at a high lithium grade of 1.38% Li2O. The company has recently signed a memorandum of understanding (MOU) with Tanco that could see the project fast-tracked using Tanco’s spodumene flotation circuit, also located in Manitoba, Canada. Snow Lake is currently in the process of listing on the Canadian Stock Exchange.

Watch »

12/08/2019 |

Bitesize briefing - Do projects with lower capex and opex intensity have higher market valuations?

Projects with lower capex intensity and lower opex should, in theory, generate higher returns assuming the projects sell the same product. In this video, we examine how the market values hydroxide and carbonate projects on an EV per tonne basis relative to a project’s opex and capex intensity.

*Note that Desert Lion’s PEA on its Namibian Lithium project was completed before its acquisition by Lepidico. Lepidico is pursuing an alternative development strategy to that envisaged by Desert Lion and therefore does not endorse these figures.

Watch »

05/08/2019 |

Bitesize briefing: How does the capex intensity of brine projects compare to other lithium deposits?

It is widely believed that the capital cost of developing a brine project is higher than the cost of developing igneous or sedimentary lithium deposit projects. But how do they compare on a life of mine capital intensity basis?

Watch »

29/07/2019 |

Bitesize briefing - How does the opex of lithium brine projects compare to other lithium deposits?

It is widely believed that lithium brine projects have a lower operating cost (opex) than igneous and sedimentary lithium deposits, but is that really the case? We look at the economic studies of 25 lithium projects to see if brine projects actually are lower cost.

Watch »

22/07/2019 |

Bitesize briefing - Lithium prices used in economic studies compared with Q119 prices

In this video we look at lithium prices used in economic studies for concentrate, carbonate and hydroxide-producing igneous, sedimentary and brine projects. We compare them with prices seen in the first quarter of 2019, to determine whether companies are being conservative or bullish with their project economics.

Watch »

15/07/2019 |

Bitesize briefing - Global lithium production targets

In this video we look at the production of lithium-bearing concentrate, lithium carbonate, lithium hydroxide and lithium fluorite from igneous, sedimentary and brine lithium deposits. We divide production into large, mid and small scale to help investors assess the relative significance of the planned production level from a specific operation.

Watch »

08/07/2019 |