Strategy update and platform for growth

A capital markets day (12 April) followed the trading update and included presentations from CEO Nick Kelsall and five business MDs representing almost 90% of annualised group revenues. As well as highlighting business breadth, common core characteristics and collaboration-driven synergies across the portfolio, this event was used to set out management’s medium-term aspirations, as follows:

■

Group revenue of £600m by 2023 targeted. This is equivalent to a c 13% CAGR; underlying market growth alone is unlikely to be sufficient to deliver this near-doubling of the top line in five years (versus FY18 £320–330m, including Merlyn for a full year) in our view. So acquisitions continue to form part of the strategic thinking and, of course, progress is unlikely to be linear.

■

Broadly even UK/overseas revenue split. For context, overseas sales were c 45% of reported FY18 revenue. The intention is to broadly retain this balance during the next growth phase and this may include exposure to faster-growing overseas markets and UK subsegments and acquisitions which could have an export bias or be located outside the UK.

■

Sustainable underlying ROCE in excess of 15%. The previous strategic target was to sustain this metric in the 12–15% range (and £420m FY18 revenue, including potential acquisitions). Norcros attained 18% ROCE in FY18 and clearly maintained a focus on quality rather than quantity regarding acquisitions made. We estimate that underlying profitability (ex-acquisitions) increased between FY13 and FY17, driven by South Africa, but there is also scope to improve UK returns over time. In a wider context, this premise and an 18% starting point provides some latitude to take on acquisitions on lower initial returns. We believe the company has a good acquisition track record and the raised through the cycle ROCE aspiration suggests that any dilution from the current level would be considered, but still allows for a significant margin over the group WACC of c 9%.

In our view, the overall strategic thrust and direction outlined above is unchanged from before. These updated targets indicate that the management team intends to build on the current platform and has significant ambition to grow revenue and profits.

Some regional perspective: the capital markets day provided information on the group’s current primary markets, which are most obviously the UK (c £2.3bn annual market value in the widely defined bathroom and kitchen products sector at manufacturer’s selling prices), South Africa (c £0.9bn), as well as the Middle East (specifically UAE and Qatar, c £1.1bn). As a broad illustration, based on the information presented, Norcros’s current portfolio addresses sectors that make up roughly three-quarters of these markets.

The UK market has the most balanced spread of subsectors (the largest – mixers, taps and controls – being c 20%), while South Africa has a more significant tile bias (around one-third, the remainder spread) and the specified Middle Eastern markets more so (60%+). In these overseas markets, we think it reasonable to expect an increasing demand for improved specification fittings, etc, over time, broadening beyond the high-end residential and commercial (hotels, apartments, offices) customer sectors. We also note that the two overseas markets both have a significant local player with a diversified portfolio: Italtile in South Africa and RAK Ceramics in the Middle East. As a reminder, Norcros has strong, branded number one or number two positions in its sectors in both the UK and South African markets. It has also sold into the Middle East for a number of years and, following 2016 distributor changes, now has a regional sales office and stocking capability centred around the Vado and Norcros Adhesives offerings.

Identifying commonalities across a diverse business portfolio

We highlight below some of the characteristics that we feel each of the individual businesses that presented at the CMD have in common; together, they provide the essence of the group business model.

■

Strong portfolio of brands

Our perception is that portfolio companies typically have leading market positions – usually with a single brand used by each company across the sectors it serves – and a mid/upper end bias, although not exclusively so. (We understand that some white-label manufacturing takes place to varying degrees around group companies, but this is not thought to be material in aggregate.) Pulling together provided data, market shares are:

•

Triton: UK 34% total (51% electric, 11% mixers) and 69% in the Republic of Ireland

•

Merlyn: UK 15%, 35% Republic of Ireland

•

Johnson Tiles: UK total 12%, wall tiles 21% (one of only two scale UK producers)

•

South Africa: retail 10% (number two), JTSA (number two), adhesives (number one)

■

Embedded innovation culture

In support of their market-leading positions, each company is clearly mandated to be active in new product development (NPD) and for this activity to make a material contribution to revenue. In largely established market segments this includes adding new features, updating appearance, range extensions, enhancing user experience and improving installer convenience. Regularly moving the product offering forward represents a constant challenge to competitors but also provides opportunities for margin consolidation/expansion from both cost (through design-for-manufacture and parts/sourcing commonalities) and pricing perspectives. We understand that in aggregate c 2-3% of annual group revenues are expensed or capitalised as NPD.

The following examples illustrate the significance of NPD at individual company level, noting percentage of revenue derived from products introduced in a specified time period (number of years in brackets):

•

South Africa 47% (three years); own-branded tap range (EVOX), adhesives formulations, Tile Africa range expansion

•

Triton 34% (three years); Fast Fit showers, digital controllers and mixers

•

Johnson Tiles 19% (two years) – exclusive customer ranges, smaller-format tiles

In overall terms, the equivalent figure for all existing UK operations is c 25% (three years). Merlyn, while being below this at the point of acquisition, already had new product momentum and is moving towards this UK average. Across the portfolio, there are examples of inter-company product development (eg Triton/Vado electric showers range, Vado/South Africa tap range), which further highlights the potential benefits from shared group expertise. Apart from the product portfolio fit, an ability to innovate and refresh the product range and potential to collaborate are clearly important considerations in making acquisitions.

■

Group sourcing synergies

Norcros’s operating companies have a range of different business models. Four of the seven UK businesses (ie Vado, Croydex, Abode and Merlyn) supply products that are internally designed and effectively externally sourced, except for some light assembly activity. Triton undertakes full final product assembly of its proprietary shower designs, for which the cover, sub-assemblies and components are bought-in. Consequently, supply-chain management is a critical discipline and Norcros has an extensive Chinese sourcing network including 35 locally based employees across a number of locations. Even if they were entirely independent, there would still be economies of scale in collective transportation and shipping arrangements. In fact, there are a number of product group overlaps such that group purchasing synergies can also be achieved. Some of the major product groups include:

•

brassware: valves, taps, fittings (Vado, Abode, Triton)

•

plastic injection moulded components: covers, shower heads (Triton, Croydex)

•

chrome-finish components: accessories, hoses, rails (Triton, Vado, Croydex, Merlyn)

Clearly, where acquisitions also fit this model, this brings opportunities to improve supply terms for the acquired company and potentially for the wider group. Glass panels and shower trays form the largest value elements of Merlyn’s offering sourced from China; while there is limited overlap with the rest of the group in these areas, we would expect some group sourcing benefit to be extracted.

JT and JTSA both have significant tile manufacturing facilities but, to broaden their offering, also source and import a significant proportion of revenues from third-party products and are able to share market intelligence and supply contacts (eg in Turkey, Spain, eastern Europe). Only the surface preparation product companies (ie Norcros Adhesives, UK and TAL Adhesives, South Africa) are pure manufacturing operations, largely for their local markets. Tile Africa is the only group retail business; it obviously relies heavily on JTSA and TAL for tiles and adhesives, respectively, but also accesses group supply chain capabilities in sourcing its brassware and fittings requirements.

Norcros typically hedges its expected FX cost exposure on a rolling nine-month basis. As a result, exchange rate fluctuations should have limited impact on in-year estimates; although, of course, as existing covers rolls off, prevailing rates become more relevant to future period forecasts. We are not aware of any hedging relating to underlying commodity pricing (eg metals) and believe that customer pricing is adjusted periodically – albeit with a lag – to take account of such movements. Imports form a significant proportion of the products sold in Norcros’s market segments in both the UK and South Africa, and competing suppliers are likely to face similar challenges, we believe.

■

Breadth of distribution channel expertise

Exhibit 2 summarises Norcros’s business portfolio together with the subsector focus of each constituent company.

Exhibit 2: Norcros business portfolio

|

|

Source: Norcros, Edison Investment Research. Note: *Merlyn revenue £30.7m (year to March 2017, pre-acquisition) – although Merlyn is based in the Republic of Ireland, the UK is its largest sales territory and we have classified this as ‘Domestic’ here for interpretation consistency with the other UK based companies.

|

From FY13 to FY17, through relative subsector performance and portfolio additions, the UK FY17 revenue split (as reported) by distribution channel evolved as follows:

■

UK domestic 85%, export 15% (FY13 89:11)

Triton has traditionally had a good export presence (especially in the Republic of Ireland) with Johnson Tiles and Norcros Adhesives also having some exposure. At the point of acquisition, Vado had c 40% revenue generated overseas, but this has since been diluted to some extent by strong UK growth as part of the group.

■

Within the UK portion of revenue, specific routes to market in this year were (figures rounded) Trade 49%, DIY retail 24%, specialist/independent retail 11%, other 2% (FY13 41:42:3:2).

The most notable swing during this period was into the other categories and away from DIY retail. Soft markets and sourcing changes by larger customers have affected JT especially, but also Triton and Croydex in this subsector. More positively, greater penetration of specialist retail and the new housebuilding (served through trade) segments – partly through acquisition and partly through NPD – have more than offset DIY pressures. The inclusion of Merlyn, (acquired in November 2017), further boosts exposure to these two channels, which continue to offer better growth prospects in the near term.

As things stand, there is less complexity in Norcros’s channels in South Africa. Most obviously, Tile Africa is essentially a pure, domestic market retailer, although some smaller contract work is also conducted through its stores. JTSA and TAL Adhesives both supply product into Tile Africa but also to other independent retailers and wholesalers, commercially specified projects and export to sub-Saharan markets. In aggregate, exports – chiefly to contiguous countries – accounted for 19% of JTSA and TAL’s reported FY17 revenue. We estimate that domestic sales in South Africa have risen by a c 12–13% CAGR in the last five years and all three businesses have achieved growth rates around these levels, while export growth of manufactured products to third parties have seen a 19% CAGR. It is important to note that these growth rates have all been achieved organically.

Norcros’s UK distribution channel presence is clearly illustrated by listing the multiple formats belonging to three quoted building materials supply-chain customers supplied by the group, ie

■

Travis Perkins – general merchanting, trade (Benchmarx), DIY (Wickes), retail (Tile Giant)

■

Kingfisher – DIY (B&Q), trade (Screwfix)

■

Grafton – general (Buildbase) and specialist (Plumbase) merchanting

The detail is more nuanced than this, with both channel depth (multiple suppliers to each segment) and diversity (more than one segment served by each individual company). This provides access to a wide range of end-customer types within both residential (directly through DIY/specialist retail, indirectly through trade) and non-residential (trade, commercial projects/specification sales) sectors. Some other examples of customers in each segment who are all served by more than one group company are shown below.

■

Trade – other general merchants (Jewson) plumbers’ merchants (eg Wolseley, Graham)

■

Specification – Material Lab is the London-based showcase for Norcros group products (and complementary third-party ones, eg paint, floorcoverings) addressing the project segment. Typically fulfilled through merchant chains, although not exclusively, and includes housebuilders (eg Berkeley, Redrow) and hotel chains (eg Hilton, Holiday Inn)

■

Retail – general (Argos, Dunelm), specialist (Topps Tiles), DIY (Homebase/Bunnings), online (Soakology, Victorian Plumbing)

In-depth channel knowledge aids the identification of new market opportunities such as product gaps and cross-referral of group companies. NPD activity and associated investment decisions are advantaged by the scale brought by these established market positions.

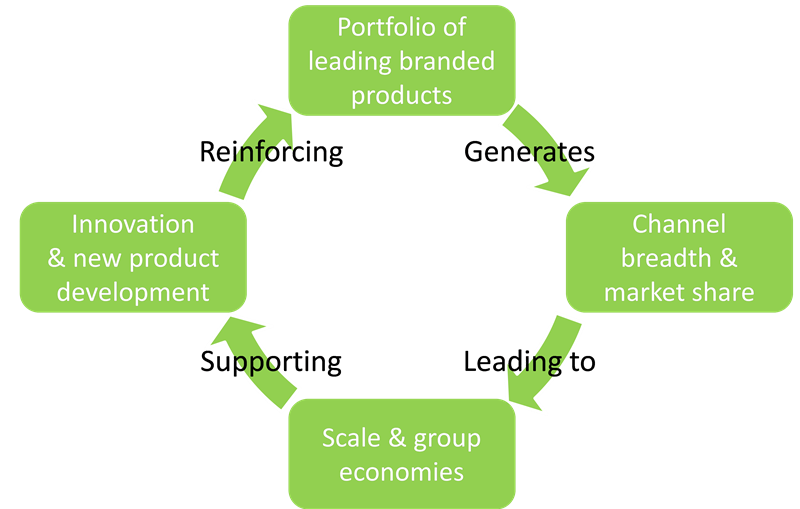

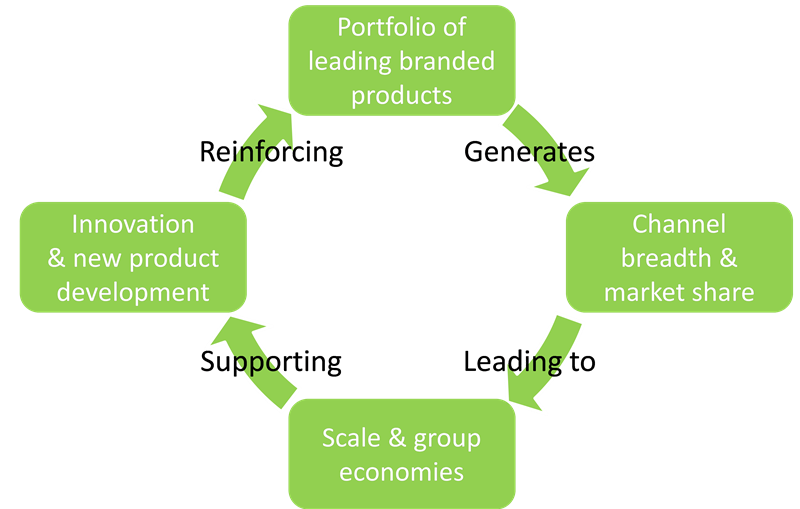

A collective consideration of the common attribute discussions above brings a useful perspective on the Norcros group business model, which we summarise in Exhibit 3. It operates in established and competitive markets; constantly evolving the product offer avoids commoditisation, and sustains brand differentiation and relative pricing power. Underpinned by co-ordinated supply chain and cost management, this forms the basis for healthy profit generation.

Exhibit 3: Norcros business model

|

|

Source: Edison Investment Research

|

It is clear that the company has a strong and broadly based platform from which to address its new 2023 targets. Business fit is a key criteria and this provides a framework with which we can appraise potential future expansion.

Some thoughts on acquisitions: having referenced acquisitions in a couple of places above, we now make a few observations on potential fit with the existing portfolio and include some examples pictured in the capital markets day presentation. (We took these to be illustrative rather than definitive.) We categorise the opportunities as follows:

■

Infills – close synergistic fit with the existing portfolio; waste, drainage fittings (to co-ordinate with taps, showers, shower trays), range extensions (eg specialist adhesives/surface preparation formulations, screens). Sanitaryware is the most obvious portfolio gap, although there are some significant international players and recognised brands in this space.

■

Adjacent products – additional discrete product lines for the same bathroom and kitchen target markets that could use existing channel expertise or add new specialist ones; lighting (higher reg rating), furniture/cabinets/storage, panel products.

■

Adjacent other – with increasing attention being given to modular construction methods, by having a wide range of products the group is well positioned to service a potentially new market segment. Depending on how this evolves, adding a service package or even light fabrication capability could reinforce the product offer.

■

Regions – South Africa has a relatively underdeveloped own product offer compared to the UK, though inter-trade is increasing (eg Vado). Subject to local market requirements, Norcros could broaden its range organically or via acquisition. This also applies to market development, where we understand the commercial/trade channel is relatively immature. Norcros has a modest local sales representation in the Middle East currently (through Adhesives and Vado in Dubai, now including some local stocking) and building a more significant channel presence would seem to be a logical step. Elsewhere, Brazil has been highlighted as a large low-pressure market where the group has undertaken market and product soundings.