SDX is acquiring the Moroccan assets of Circle, which comprise the Sebou and Lalla Mimouna areas. The Sebou permit (split into the Sebou Exploration Permit and four approved exploitation concessions) has existing gas production to a local industrial area (and exploration potential), while the Lalla Mimouna is still in the exploration and appraisal phase. Both are located in the Rharb Basin, onshore Morocco.

The assets are producing strong free cash flows and have contracts out to 2021 at high gas prices (relatively to global peers). Post-acquisition, SDX’s opportunity is to initially recycle these cash flows and explore/develop to grow reserve to supply the contracts after 2018-21 and then to explore to provide reserves to additional, longer-term contracts beyond the 2021 end date.

Exhibit 3: Sebou and Lalla Mimouna permits

|

|

Source: Circle Oil 2010 annual report

|

Sebou: Circle Oil signed a 10-year Exploration and Exploitation Agreement with ONHYM (Moroccan Government Energy Agency) for the Sebou permit (Rharb basin) in June 2006, holding 75% working interest (ONHYM holds the remaining 25%) and covering 296km2 – this has since fallen to 134km2 after relinquishments. There is an automatic right of conversion to an Exploitation Concession of up to 30 years duration for any commercial discovery; this can be extended if production continues at the end of the initial period. All necessary commitment wells have been drilled in these permits, with a high overall success rate. It is anticipated that the ongoing negotiations to renew this permit will soon be successful.

2D and 3D seismic surveys cover the majority of Sebou and 13 discovery wells resulted from 16 exploration wells (a success rate of 81%). Production operations continue on the majority of these wells. Current production is around 6.5-6.8mmcf/d gross and this is routed through a 75%-owned pipeline to the Kenitra industrial zone (we provide more details on the customers below). The capacity of the pipeline is 23.5mmcf/d (of which 7mmcf/d is currently utilised), giving the company significant headroom in adding to this if enough resources are discovered/developed and sold.

Lalla Mimouna is therefore much larger than Sebou (2,211km2 vs 134km2) and relatively poorly covered by 3D seismic, with only c 10% of the licence area covered by 3D seismic. However, the eight-year initial exploration term is due to end in January 2018, so SDX has relatively limited time to explore the area unless an extension can be agreed. The latest interim report (H116) from Circle indicated its intention to drill two wells on the Lalla Mimouna permit in 2017.

Circle was awarded the Lalla Mimouna permit in January 2010 (covering 2,211km2), which was subject to an initial eight-year life that could be extended to a maximum (but extendable) 25-year exploitation period for any commercial discoveries. Circle carried out an initial 80km2 3D survey in 2010, with a further 135km2 of 3D in 2011. These data are believed to be high quality.

A drilling campaign of three wells was planned in late 2012, but this was pushed into 2013, 2014 and then 2015. In 2015, three wells were drilled. The first (LAM-1) targeted Miocene gas-bearing sands (as seen in Sebou). The primary target flowed gas at a stabilised rate of 1.9mmcf/d, while the secondary target flowed at a stabilised rate of 1.1mmcf/d. Two other wells (ANS-2 and NFA-1) were drilled but neither yielded encouraging results (ANS-2 has reservoir but pressure tests were not sufficiently conclusive, while NFA-1 was dry). No drilling has occurred on the licence since then (understandably, Circle has concentrated on Sebou). SDX plans a two well exploration campaign if the licence is extended.

Exhibit 4: Sebou and Lalla Mimouna areas, Morocco

|

|

Source: Circle Oil 2016 AGM presentation

|

As can be seen in Exhibit 5, gas prices realised by sales thus far have been high by global standards and have averaged US$8.7/mcf since 2009. The prices are driven by the limited substitutability of the gas by the customers, which produce ceramics and paper in the Atlantic Free Trade Zone (in Kenitra) on the Moroccan coast. Many of the companies in the Kenitra area are using bottled gas at prices ($18/mcf) well above the contract prices, so we would expect any volumes that are lost would (almost) immediately be replaced by another customer (and that any additional volumes that the company can produce could be sold). We are therefore comfortable that gas prices will remain close to current prices given the existing contracts (which we imagine vary slightly on a customer-by-customer basis) and the macro pressures driving any renegotiation in future.

Sebou currently supplies three companies: Supercerame (ceramics), CMCP (paper) and SBS Porcher (ceramics). As an example of pricing, SBS Porcher may be taking 0.35mmcf/d at a price of around $12/mcf (according to Circle’s last AGM presentation) in 2017. Kenitra lies 50km north of Rabat and close to the southern border of the Lalla Mimouna licence. The project is well connected by highway to Tangiers and Rabat and offers tax and customs benefits for companies setting up in the area.

Together, these contracts lead to minimum gas take of 5-5.5mcf/d, although this will fall to around 3.8mcf/d in 2018 as contracts tail off. Production history indicates that the customers regularly take more than the minimum (2015 production was 5.9mcf/d), but still below the maximum (over 8mcf/d until 2018, falling to 6mcf/d thereafter until 2022. Even with four customers, concentration risk could superficially be seen as relatively high, leading to downside risk if one goes offline or out of business (Supercerame is the largest of these and the longest dated), however the demand from other business in Kenitra currently buying bottled gas for $18/mcf reduces the impact substantially.

Exhibit 5: Sebou production history and forecast

|

|

Source: Circle Oil, Edison Investment Research. Note: Dark green denotes historical data, light green is the Edison forecast of 2P +1C. 2016 data point is for H116 only. Dotted line denotes estimated gas price realisation.

|

Existing reserves – deal frees up planned capital investment

Exhibit 6: Possible upside in our production estimates if more reserves are discovered and customers take more than the minimum volumes

|

|

Source: Edison Investment Research

|

Sebou 2P reserves were estimated to be 7.9bcf at the end of 2015, of which 5.6bcf were classified as proven. After 2016 production (and not allowing any reclassification, additions or other adjustments), we estimate year-end 2016 2P reserves of 5.7bcf (and 3.4bcf of 1P). This means that the company will have to convert some of its existing 3P or contingent resource/ reserves to supply the contracts as they currently stand. Current production cannot be sustained with the current well inventory indefinitely, so drilling will have to follow the deal to fulfil the contracts and/or provide for any extensions/additions after the contracts end in 2021.

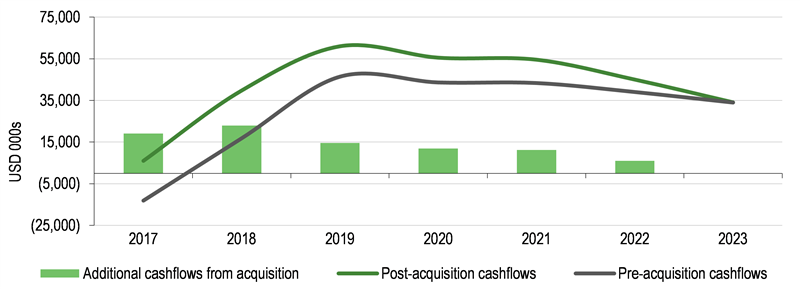

For the moment we model that SDX will mirror Circle’s capital investment plan over 2017-21 to work over existing wells, drill new development wells to bolster reserves and improve facilities and pipeline capacity (and drill exploration wells where appropriate). Indeed, in our accelerated investment plan modelling we see over $30m invested in Morocco in the next five years. This is well within the cash flow generation of the asset, we which estimate to be over $60m in this period. In addition, the cost of drilling and service work has fallen materially, so capital efficiency will be far higher for SDX’s investment than it may have been a few years ago, while we expect SDX to introduce modern techniques that have not been implemented in Sebou previously.

Although the results of any given well cannot be guaranteed, Circle had a good success rate in drilling wells historically, so we are not overly concerned about the risk that future wells will not be able to fulfil the reserve estimates/contracts at this time, although this possibility always exists. We note that the 2015 change of auditor (to Senergy) re-categorised 2P reserves to contingent, reducing the 2P number significantly. If we include even a portion of these contingent reserves (given the extensive drilling plans), the 2P would likely rise to above our modelled reserve requirement (see below).

We model a budget of 10 wells, seven of which may be successful. This is below the historic success rate at Sebou of 80%. We do not explicitly include any value beyond this (either at Sebou or at Lalla Mimouna), but note that discoveries would likely be easily monetised. At $2-2.5m per well, these cash flows will fund many wells.

Exhibit 7: Reserves at Sebou

|

|

Source: Circle Oil. Note: In 2012, Circle did not report 1P reserves (although they did exist). In 2015, the fall in reserves is primarily due to production during the year and the reclassification of 2P reserves to contingent. 2016 data shown relate to mid 2016.

|

The acquisition gives SDX an additional 40% working interest in the NW Gemsa field (on top of its existing 10% stake). The other 50% will continue to be owned by ZhenHua Oil, which will remain operator. The field needs little additional capital to be invested and we expect the field to continue to decline over time, although the company will now receive half the cash flows (previously 10%).

The production of the field has been below our expectations in 2016, and we take the opportunity to reduce the forecast production for NW Gemsa. In particular, we had expected a levelling off of the production decline for a number of quarters following the workover programme in 2016, but the field has fallen from 7.8mb/d in Q116 to 6.5mb/d in Q3 (an annualised decline of 20%). We therefore move our modelling towards the 2P production profile, as our previous more optimistic case (above or around the 3P case) has not been realised. We note the company plans a 12 well workover programme starting in 2017 (eight producers and four injectors), so we expect an effect on production this year, hence the phasing of production profile vs the CPR numbers.

This does not detract from the cash generation and value of the asset, given its low opex and capex requirements. We expect these to be recycled into Meseda to fund the workover/waterflood programme over the next few years.

Exhibit 8: NW Gemsa production modelling

|

|

Source: Edison Investment Research, SDX Energy

|

The acquisition has no impact on SDX’s Meseda stake, other than providing cash flows from NW Gemsa to fund investment in the workovers/waterflood. However, we have reduced our expectations on production from Meseda vs our previous modelling as work has been delayed on the workover/waterflood. We expect to update this as the waterflood programme commences and results start to come through this year (the work, including a facilities upgrade, well workover programme, infill well drilling and two exploration wells is due to start in Q117).

Our 2017 estimates require a notable increase from Q316 production rates of 3,657b/d to reach our modelled average rate of 5,500bbls/d. As a result, we will be watchful of the improvements that can be made in the early stages of 2017, but highlight that the prize at Meseda remains significant if the waterflood proves successful.

Exhibit 9: Production profile for Meseda

|

|

Source: Edison Investment Research, SDX Energy. Note: Q316 average production was 3,657b/d at Meseda.

|

Independent of the acquisition, we have made a number of changes to our modelling and valuation (many of which have been mentioned earlier in the report). The primary changes are:

1.

The re-phasing of the Meseda production expectations. We had previously modelled a larger production impact early in 2017 – this will take longer. We have also reduced the production peak and profile, reducing the recoverable barrels in the waterflood upside case, while also requiring a re-phasing of capex.

2.

Given the continued fall of production rates seen in 2016 (vs our expectation of a steadying plateau), we have reduced our production estimates at NW Gemsa.

3.

Increasing the discount received for Meseda oil (nudging this discount up to 40%).

4.

Tweaking our 2017 oil price assumption from $51.8/bbl to $51.7/bbl. Our longer-term oil assumptions are unchanged.

As a result, without the impact of the acquisition, our core valuation would have fallen from 39p/share to 29p/share (and from 68p/share to 55p/share for the RENAV).

Impact of the acquisition

After the deal, the revised valuation for the larger entity benefits from the additional working interest at Gemsa, but the cash flows from Sebou (Morocco) are the foundation of the bulk of the value, although a large working capital balance of $18m at acquisition contributes strongly; for the purposes of the valuation, we model that this $18m is released over four years (we assume the bulk of it is in Egypt, where Circle has experienced difficulties in receiving payment in US$). This situation should be eased by SDX as it is happier to receive payment in Egyptian pounds and recycle this within country.

Until well targets at Lalla Mimouna are announced and their impact on the company can be more properly assessed (including any costs and time to build extra pipeline), we exclude them. However, we would expect SDX to update the market in the relatively short term on its exact exploration plans in Morocco.

The additional absolute value is balanced by the new equity raised to fund the acquisition – the recent rise in the share price means that fewer shares should need to be issued, reducing share dilution. This leaves the larger entity with a notably higher valuation, as seen below.

Asset |

Number of shares: 187m |

Recoverable Reserves |

|

Net risked value |

Country |

Diluted WI |

CoS |

Gross |

Net WI |

Net attributable |

NPV |

Absolute |

GBp/ share |

C$/share |

|

% |

% |

mmboe |

$/boe |

$m |

12.5% |

|

Net (Debt) Cash - Dec 2016e |

|

100% |

100% |

|

|

|

|

7.2 |

3.1 |

0.05 |

Cash raised minus acqn minus costs |

|

100% |

100% |

|

|

|

|

7.3 |

3.1 |

0.05 |

SG&A - NPV10 of 4yrs |

|

100% |

100% |

|

|

|

|

(13) |

(5.7) |

(0.09) |

2017 Exploration |

|

100% |

100% |

|

|

|

|

(3) |

(1.3) |

(0.02) |

Receivable for gas and NGLs at Gemsa (as yet not invoiced) |

100% |

100% |

|

|

|

|

1.5 |

0.6 |

0.01 |

Production |

|

|

|

|

|

|

|

|

|

|

Meseda Base case - Edison |

Egypt |

50% |

100% |

4.0 |

2.0 |

0.8 |

6.2 |

12 |

5.3 |

0.09 |

Meseda Base + Workovers - Edison |

Egypt |

50% |

90% |

4.5 |

2.2 |

0.9 |

6.0 |

12 |

5.2 |

0.09 |

Gemsa 1P |

Egypt |

50% |

100% |

4.1 |

2.1 |

2.1 |

9.1 |

19 |

8.1 |

0.13 |

Gemsa 2P |

Egypt |

50% |

100% |

2.3 |

1.1 |

1.1 |

12.2 |

14 |

6.0 |

0.10 |

Sebou 2P |

Morocco |

75% |

100% |

1.0 |

0.8 |

0.8 |

34.6 |

26 |

11.4 |

0.19 |

Acquired working capital (NPV of 4 yr release) |

Morocco |

100% |

100% |

|

|

|

|

15 |

6.2 |

0.10 |

Core NAV |

|

|

|

15.9 |

8.2 |

5.6 |

10.2 |

98 |

42.1 |

0.69 |

Development upside |

|

|

|

|

|

|

|

|

|

|

Meseda Base + Workovers + Waterflood - Edison |

Egypt |

50% |

40% |

9.3 |

4.6 |

1.8 |

4.6 |

8 |

3.7 |

0.06 |

Gemsa - Edison modelling on full field |

Egypt |

50% |

75% |

3.0 |

1.5 |

1.5 |

7.8 |

9 |

3.8 |

0.06 |

Sebou - Accelerated programme |

Morocco |

75% |

40% |

0.9 |

0.7 |

0.7 |

7.6 |

2 |

0.9 |

0.01 |

Exploration (known) |

|

|

|

|

|

|

|

|

|

|

SouthDisouq- Ex Egypt |

Egypt |

55% |

13% |

64.8 |

35.6 |

35.6 |

3.4 |

16 |

6.8 |

0.11 |

Development and exploration NAV |

|

|

|

78.0 |

42.4 |

39.6 |

0.8 |

35 |

15.1 |

0.25 |

Full NAV |

|

|

|

93.9 |

50.6 |

45.2 |

2.3 |

133 |

57.1 |

0.94 |

Source: Edison Investment Research